Category: Miscellaneous

India and Bangladesh: Teesta River Issue

- by IAS Score

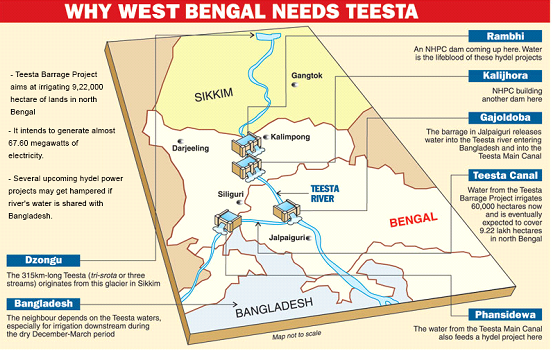

The Teesta River water sharing issue has loomed large over India-Bangladesh relations for over a decade. Hereby, analysing the issue in detail.

What are the salient features of Teesta River?

The Teesta River originates from the Pauhunri Glacier, Teesta Kangse near Khangchung within the Eastern Himalayas, Sikkim of India.

From the Pauhunri Glacier (a great snow peak in the Himalayas), the Teesta finds its way through the Darjeeling ridgein a narrow and deep gorge with a meandering course.

Teesta then runs downhill through Sikkim and Darjeeling hills for 172kms, then meanders along the plains of West Bengal for about 98kms and eventually enters Bangladesh where it flows into River Brahmaputra at Fulchori.

What is the importance of Teesta River?

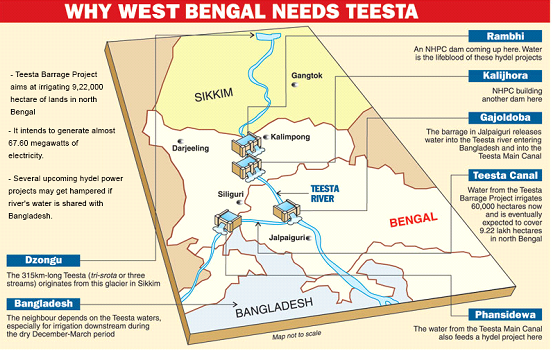

The Teesta originates in the Indian state of Sikkim and its total length is 414 km, out of which 151 km lie in Sikkim, 142 kms flow along the Sikkim-West Bengal boundary and through West Bengal, and 121 km run in Bangladesh.

In Bangladesh, the River mainly affects the five northern districts of Rangpur Division: Gaibandha, Kurigram, Lalmonirhat, Nilphamari and Rangpur. According to a report on the Teesta by The Asia Foundation in 2013, its flood plain covers about 14% of the total cropped area of Bangladesh and provides direct livelihood opportunities to approximately 7.3% of its population.

For West Bengal, Teesta is equally important, considered the lifeline of half-a-dozen districts in North Bengal.

How River sharing is impacting relation of India and Bangladesh?

India as both upper & lower riparian state has come into conflict with most of its neighbours on the issue of cross- border River sharing.

In spite of sharing 54 Rivers, India & Bangladesh have an agreement in place only for sharing of oneRiver, the Ganges signed in 1996.

This treaty rather than diffusing the water conflict has only heightened the perceived neglect of Bangladesh as a lower riparian state due to large scale desertification of areas of north west Bangladesh due to reduced discharge available at Farraka Barrage. The aim of construction of the Farakka Barrage was to increase the lean period flow of the Bhagirathi-Hooghly branch of Ganga to increase the water depth at the Kolkota port which was threatened by siltation. This is due to over drawl by the states of Uttar Pradesh & Bihar as these upper riparian states were not included as part of the treaty. Thus, lack of internal water sharing agreement for Ganges River has resulted not only in threatening the survival of the Kolkata port, it has also caused straining of relations between India & Bangladesh.

The Bangladesh government feels that the reduction in flow caused damage to agriculture, industry and ecology in the basin in Bangladesh. Because of the inability of the concerned governments to come to any lasting agreement over the last few decades on sharing the River water, this problem has grown and now it is also viewed as a case of upstream-downstream dispute.

Even though UN Convention on the Law of the Non-Navigational Uses of International Watercourses, 1997 attempts to resolve such issues amongst riparian states, as India & Bangladesh are non-signatories to this convention, the issue of distribution of water & its management is straining Indo-Bangladesh relations despite Indian attempts at reviving the relationship with Bangladesh to a new level of trust & cooperation.

What are the other water related disputes?

Construction of the Tipaimukh Dam is another contentious issue between India and Bangladesh. Tipaimukh Dam is a hydel power project proposed on the river Barak in Manipur. Bangladesh’s objection is that it would have adverse ecological effects in its eastern Sylhet district. In spite of India’s reiteration that no dam would be constructed overlooking Bangladesh’s objections, the controversy is far from over.

The popular arguments in Bangladesh against the Tipaimukh project are:

- India should not decide what is good for people of Bangladesh without taking them into confidence;

- No study has been undertaken in Bangladesh to assess the impact of the ecosystems that exist and depend on the natural flow of the water in Surma-Kusiyara-Meghna and their tributaries.India and Bangladesh have agreed on a joint study group to examine the points raised by Bangladesh.

How the Teesta river dispute originated?

Historically, the root of the disputes over the River can be located in the report of the Boundary Commission (BC), which was set up in 1947 under Sir Cyril Radcliffe to demarcate the boundary line between West Bengal (India) and East Bengal (Pakistan, then Bangladesh from 1971). In its report submitted to the BC, the All India Muslim League demanded the Darjeeling and Jalpaiguri districts on the grounds that they are the catchment areas of Teesta River system. It was thought that by having the two districts, the then and future hydro projects over the RiverTeesta in those regions would serve the interests of the Muslim-majority areas of East Bengal. Members of the Indian National Congress and the Hindu Mahasabha opposed this. Both, in their respective reports, established India’s claim over the two districts. In the final declaration, which took into account the demographic composition of the region, administrative considerations and ‘other factors’ (railways, waterways and communication systems), the BC gave a major part of the Teesta’s catchment area to India.

After the liberation of East Pakistan and birth of a sovereign Bangladesh in 1971, India and Bangladesh began discussing their transboundary water issues. In 1972, the India-Bangladesh Joint Rivers Commission was established.

What is the present agreement related to Teesta?

In 1983, an ad hoc arrangement on sharing of waters from the Teesta was made, according to which Bangladesh got 36% and India 39% of the waters, while the remaining 25% remained unallocated.

A lesser share for Bangladesh takes into account a groundwater recharge that takes place between the two barrages on the Teesta — at Gazaldoba in Jalpaiguri on the Indian side and at Dalia in Lalmonirhat in Bangladesh. The remaining 25 per cent was left unallocated for a later decision. Especially because the regular flow of a small quantity of water (in the case of the Teesta, 450 cu secs) is imperative for the life of a river.

What are the salient features of the 2011 agreement?

Delhi and Dhaka reached another agreement — an interim arrangement for 15 years — where India would get 42.5 per cent and Bangladesh, 37.5 per cent of the Teesta’s waters during the dry season. The deal also included the setting up of a joint hydrological observation station to gather accurate data for the future. However, the deal was rejected by the West Bengal Chief Minister. Mamata Banerjee is of the view that the water-sharing would be against the interest of West Bengal farmers and people. She feels that the loss of higher volume of water to the lower riparian would cause problems in the northern region of State, especially during drier months.

What is the role of state in Water Sharing Agreement?

Although Article 253 of the Indian constitution gives power to the Union government to enter into any transboundary river water-related treaty with a riparian state, the Centre cannot do it arbitrarily without taking into consideration the social, political and economic impact of such a treaty in the catchment area.

Further foreign policy is a central subject in India. The states do not have jurisdiction in determining India’s external relations. That is an area to be handled exclusively by the government at the centre. But given the steady rise of regional parties and the increasing dependence of governments in New Delhi on their state allies, the impact is being felt in the area of foreign policy as well.

What are the present issues?

The present issue related to Teesta River is due to the formation of hydroelectricity dams.

- The rapid development of hydropower projects in Sikkim, and indeed in large parts of the northeast has been a growing cause of concern in India.

- The region has witnessed an increasing number of landslides. The reduced flow of the river particularly in the lean season has made performing river related rites difficult.

- The concerns center on the social and environmental impacts of run of the river projects that reroute the river through tunnels, bypassing long stretches of the natural river course.

- The dams upstream on the Teesta and its tributaries in Sikkim are creating a substantial reduction in water flow downstream, owing to periodic landslides, siltation, etc., notwithstanding the fact that these dams do not provide for water storage.

- Siltation has been a major problem, with projected capacities decreasing at alarming rates, often before the entire project is completed. Evaporation from the reservoirs and seepage of water from canals deprived the marginal land of the command area from the water that it was assured during the planning of the project. The dams that were designed to moderate floods have created floods by releasing.

- Furthermore, the Teesta Barrage Project (TBP) at Gajoldoba in Jalpaiguri district of Bengal constructed at a cost of more than Rs. 1300 crore may be deemed as anotherde facto bottleneck in the resolution of the water sharing process. The TBP was conceived as a multi-purpose project in the aftermath of the massive floods in Jalpaiguri in 1968. This was done in an over-ambitious manner for flood control, power generation and irrigation of more than nine lakh hectares of command area in north Bengal. While TBP has contributed to flood control to an extent, particularly downstream of Sevoke (near Siliguri) where the river descends to the flood plains, there has been much less success towards increasing the areas under irrigation in the lower command area, apart from reducing the down-stream flows to Bangladesh. The operation of TBP and water diversion through the Teesta-Mahananda irrigation canal has changed the hydrological character of Teesta River south of Gajoldoba. These developments have contributed to a decline in the area occupied by the active river by more than 50 per cent during the 1991-2014 period. All these developments have had their consequences on the water flow to Bangladesh.

What should be the future course?

Water is a key resource that sustains life on planet earth and a critical element for human beings for their survival, healthy life, entertainment and social and economic development. With population growth and ever expanding urbanization and industrialization resulted in the ever increasing imbalance between water availability and water demand. More than a billion people are living in areas of physical scarcity, and half a billion people are approaching similar situation.

An easy resolution may not be feasible under the hydrological conditions prevailing at present. Unless an integrated view of Teesta basin management is adopted, the water and power needs of Sikkim and Bengal cannot be attended to in juxtaposition to the needs of Bangladesh in the Rangpur command area. A comprehensive river basin management approach is a sine qua non for optimum gains, not only for both India and Bangladesh, but also for the riparian regions and states along the Teesta.

Globalization and its impact on Citizenship

- by IAS Score

Citizenship implies full and equal membership of a political community. In the contemporary world, states provide a collective political identity to their members as well as certain rights. Therefore we think of ourselves as Indians, or Americans, depending on the state to which we belong.

However, the precise nature of the rights granted to citizens may vary from state to state but in most democratic countries today they would include some political rights like the right to vote, civil rights like the freedom of speech or belief, and some socio-economic rights which could include the right to a minimum wage, or the right to education. Equality of rights and status is one of the basic rights of citizenship.

Due to the concept of Citizenship, Citizens expect certain rights from their state as well as help and protection wherever they may travel.

However due to globalization the concept of citizenship with respect to particular state is becoming more complex.

The movement of people across national boundaries to live and work calls into question issues of national identity and belonging, of membership in a polity, and of the rights that accrue to that membership. For example, an Indian who have migrated from the country for work and renounced once citizenship wants to reconnect with the nation. Then question arises what their rights and duties are with respect to the India.

To meet this requirement Government of India has come up with concept of “Overseas Citizen of India”. An Overseas Citizen of India or OCI is the licence to get lifelong visa to travel seamlessly across India. Its holder is defined as:

- The one who formerly resigned Indian citizenship.

- The one whose parents, grandparents or great grandparents were once the citizen of India.

- The one who is married to an existing OCI or India’s citizen and the wedding is at least two years old.

| Benefits of OCI

· The card holder can travel without visa in India multiple times for lifelong. · They can become the citizen of this country if they continue to retain OCI card for 5 years. But here is a condition applied that that person would have spent at least one year in India. And also, the breaks for short intervals are allowed. · Immigration check posts have separate counters for their speedy verification and entry. · Separate visa for student and employment is not needed. · They can open NRE, NRO or FCNR account in Indian banks. · Indian market, except non-farm property and exercise property ownership rights, is open for them to invest · They can use it for getting driving licence and PAN Card · Economic, financial and educational leverages will be theirs just like NRIs. · They can visit National Parks, monuments, Wild Life Sanctuaries and museums provided they have paid the requisite fee for OCIs. · They also can be registered with FRRO. No time of stay is considered in their case. Drawbacks of OCI · Buying agricultural land or farm house or plantation property is not their right. · They can’t vote like PIOs. · They can’t run public office also. · Government jobs & political positions are not for them · Need special permission to visit certain restricted locations here. |

The above example states that the classical notion of democratic citizenship, which was essentially linked with the territory of the nation-state, is gradually losing its relevance in the age of globalization.

Prior to the forces of globalization, the nation state was enjoying autonomy to confer citizenship rights to the individual. But now the state is no more the sole authority to define the nature of citizenship. With the emergence of age of globalization, different dimensions of citizenship rights are granted by number of international organizations, conventions, etc.

For example: The United Nations Convention on Migrants emphasizes the connection between migration and human rights. The Convention aims at protecting migrant workers and members of their families; its existence sets a moral standard, and serves as a guide and stimulus for the promotion of migrant rights in each country.

Similarly rights for Refugees have been defined which sets out the rights of individuals who are granted asylum and the responsibilities of nations that grant asylum.

Further the recent wave of violence and economic hardship are changing patterns of migration As movements of people across borders increase, social homogeneity within individual States declines. An increasing number of States are exhibiting characteristics of multiculturalism.’ As a result, States are increasingly faced with the challenge of developing or maintaining a sense of national cohesion and unity in a context of ethnic and cultural diversity. Key policy questions about the acquisition of citizenship arise with respect to immigrants, their immediate family members, and their descendants. It is thus raising a debate of nationalism vs. human rights. This may result into xenophobic violence as seen in Europe which may threaten the peace and stability of world.

Conclusion

Many countries are providing new form of citizenship with restricted rights and duties to integrate people together in this globalised world.

This integration of new concepts of Citizenship has lead to rise of the concept of GLOBAL CITIZEN.

A Global Citizen is someone who is aware of the wider world and has a sense of their own role as a world citizen. A global citizen, living in an emerging world community, has moral, ethical, political, and economic responsibilities such as:

- Responsibility to understand one’s own perspective and the perspectives of others on global issues.

- Responsibility to respect the principle of cultural diversity by developing tolerance.

- Responsibility to understand global issues and participate at individual level to minimize the impact such as that of Climate change.

- Global citizenship entails an awareness of the interdependence of individuals and systems and a sense of responsibility that follows from it.

Practicing oneself as global citizen is ethical as it keep oneself conscious related to one’s actions. Everyone should try to strengthen the feeling of connectedness and work towards the establishment of peaceful society but the right and duties with respect to one nation should be followed wholeheartedly (without development of chauvism).

Importance of Economic Empowerment of Women

- by IAS Score

The Sustainable Developmental Goals (Five) has emphasized on Gender Equality and empowerment of all women and girls. Few of them are stated as:

a) End all forms of discrimination against all women and girls everywhere and violence against all women and girls in the public and private spheres, including trafficking and sexual and other types of exploitation.

b) Eliminate all harmful practices, such as child, early and forced marriage and female genital mutilation.

c) Ensure women’s full and effective participation and equal opportunities for leadership at all levels of decision making in political, economic and public life.

d) Ensure universal access to sexual and reproductive health and reproductive rights.

e) Adopt and strengthen sound policies and enforceable legislation for the promotion of gender equality and the empowerment of all women and girls at all levels.

Women’s empowerment is a precondition for this. Hereby, discussing the importance of Economic empowerment of Women in this article.

First there is need to understand the meaning of Economic importance. Economic empowerment increases women’s access to economic resources and opportunities including jobs, financial services, property and other productive assets, skills development and market information.

Significance in present scenario

Achieving sustainable economic growth requires the talents, creativity, and entrepreneurial vigour of an entire population. Investing in women’s economic empowerment sets a direct path towards gender equality, poverty eradication and inclusive economic growth.

As rightly stated at Clinton Global Initiative:

Women perform 66% of the world’s work, and produce 50% of the food, yet earn only 10% of the income and own 1% of the property. Whether the issue is improving education in the developing world, or fighting global climate change, or addressing nearly any other challenge we face, empowering women is a critical part of the equation.

Barriers in economic empowerment

Despite the important reasons to support women’s economic empowerment, and the progress toward gender equality in areas such as health and education, there continues to be significant barriers in women empowerment.

As the case of India, which is highly a patriarchal society where men dominate all spheres of life; women are left in a subordinate position particularly at community and household levels. There exist multiple persistent barriers to women’s economic empowerment. Starting from birth, girls’ nutrition and health condition fare worse than boys, girls are less likely than boys to attend and finish school or acquire the skills needed to obtain higher paying jobs. Discriminatory social norms and a lack of access to quality sexual and reproductive health services leaves many adolescent girls and women unable to freely choose their partners and determine the number and spacing of their children. As a child, girls are often treated differently from male children in terms of nutrition and health care; where limited food or financial resources are available, the insufficient means are prone to be allocated unevenly in favour of the male offspring.

Girls’ and women’s disproportionate responsibilities for unpaid care and domestic work deprive them of their rights to an education, employment, political participation and time to rest and participate in social activities. Women perform the majority of unpaid household and care work. They also work for pay or profit in a raft of ways and contexts—in the formal and informal economy—as waged or salaried workers, employers, own-account workers and contributing family workers. The gender differences both in unpaid work and in all types of paid work are large and persistent, reflecting constraints on women’s economic opportunities and outcomes.

Even when women do the same jobs as men or perform work of equal value, they are paid less on average than men, although the size of the pay gap varies considerably around the world. Further hundreds of millions of women work informally without social and labour protection in law or in practice. In India, for example, some 120 million women (around 95 percent of women in paid work) work informally as do around 12 million women in Mexico (around 60 percent).

These barriers that women face are not only hurting them and their families, they are holding back societies and putting the brakes on national economies.

Examples to depict importance of economic empowerment of women

The importance of economic empowerment of women can be understood by analyzing the role played by Self Help Groups in rural development.

It typically comprises a group of micro entrepreneurs having homogeneous social and economic backgrounds, all voluntarily coming together to save regular small sums of money, mutually agreeing to contribute to a common fund and to meet their emergency needs on the basis of mutual help.

SHG contributions to development are analysed as follows:

1. The formation of SHGs has benefited its members by increasing their assets, incomes and employment opportunities and there has been a significant shift in the use of the loans from personal consumption to their being used for income generating purposes.

2. SHG has enabled households to have access to it to spend more on education than non client households. Families participating in the programme have reported better school attendance and lower dropout rates. SHGs has led to reduced child mortality, improved maternal health and the ability of the poor to combat disease through better nutrition, housing and health – especially among women and children.

3. It has empowered women by enhancing their contribution to household income, increasing the value of their assets and generally by giving them better control over decisions that affect their lives.

4. It has also increased involvement in Decision-making, awareness about various programs and organizations, increased access to such organizations, increased expenditure on Health and Marriage events.

5. Within family the respect and status of women has increased. Children Education has improved significantly. Especially girl education was very low but now SHG members are sending their children including girls to school.

Framework for women’s economic empowerment

The framework proposed by United Nation includes:

- Take action to prevent and respond to violence against women and girls in their homes, in their communities, in the world of work and in public spaces. Enforcing legal and regulatory frameworks, protocols and disciplinary procedures are critical measures.

- Take action to change discrimination and stereotypes that ascribe gender to abilities and roles, including care work, and they should remove discrimination in the workplace, through education with school-age children, advertising, media, business and civil society groups.

- Governments, intergovernmental organizations and civil society should take action to support and recognize informal workers’ organizations such as unions, cooperatives and voluntary associations.

- Strengthen women’s agency by building women’s ability to identify and act on economic opportunities, define, influence, and make economic decisions; and challenge social and cultural norms.

- Eliminate gender differentiation in legal systems that limit women’s ability to access public institutions, including the justice system; travel independently; sign contracts; or assume responsibilities within households and the economy.

- Integrate a gender lens into government policies, budgeting, and resource allocation including taxation, program spending, and social protection, and support gender equality impact assessments or audits.

- Promote gender equality in public sector employment by establishing gender targets or quotas for hiring and top-level positions within the public sector, and measure progress toward those targets or quotas.

- Strengthen the institutional capacity of government agencies for economic development and women’s affairs to address women’s economic empowerment.

- Increase women’s ability to operate a business, including managing administrative burdens and taxation. Improve women’s access to commercial dispute-resolution processes and improve the responsiveness of commercial justice to women-led businesses, including in the informal sector.

- Improve the status, protection, and benefits associated with both regular and irregular work arrangements, such as casual, temporary, seasonal, contract, part-time, and migrant work, where women are concentrated.

- Improve health and safety measures in sectors where women are concentrated, including agriculture, manufacturing sectors such as garments and textiles, the informal economy, home-based work, and migrant work.

- Target women-led businesses and farms with development and extension services in areas such as agricultural practices and natural resource management, marketing, production standards, value-chain entry points, and links to markets and buyers

- Make education and training delivery more responsive to women, adapt curriculums to avoid gender stereotyping, and provide young women and men with information on the jobs and earnings associated with various educational choices.

- Support women’s representation in corporate boards; entrepreneur, farmer, and worker associations; and community and other organizations.

The barriers to women’s economic empowerment are deeply ingrained and universal. They require a multipronged approach by all four sets of actors (government, business, civil society and UN and multilateral organizations) working simultaneously and in partnership. Women will have to empower themselves from below in order to compel the government to empower them from above. Women should raise their voice for equal participation.

MAYURI KHANNA

Questions related to the topic:

1. Unless society accepts gender equality as a fundamental principle of human existence all efforts of Economic growth will only partially bear results. Do you agree with the statement?

2. Discuss the two-way linkage between Women Empowerment and Economic Development?

Climate change and human rights

- by IAS Score

“Climate change threatens our ability to achieve sustainable development, and in some cases, our very survival.” – Ban Ki-Moon

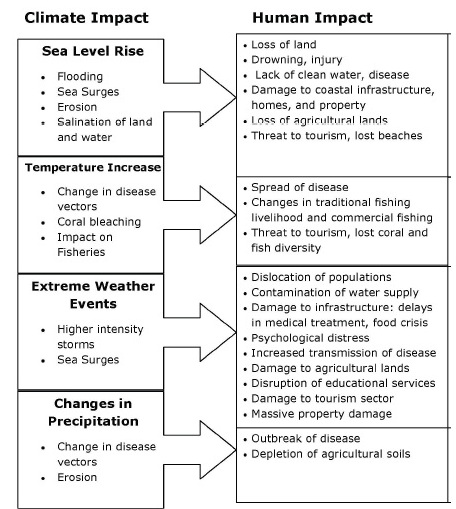

UNFCCC defines ‘climate change’ as a change of climate which is attributed directly or indirectly to human activity that alters the composition of the global atmosphere and which is in addition to natural climate variability observed over comparable time periods. The major impact of climate change include rise in average global temperature, ice cap melting, changes in precipitation, and increase in ocean temperature leading to sea level rise.

This climate change is having widespread impact on human rights across the world including the rights to life, self-determination, development, food, health, water and sanitation and housing.

Human rights are universal legal guarantees that protect individuals, groups and peoples against actions and omissions that interfere with their fundamental freedoms and entitlements. Human rights are universal and are based on the inherent dignity and equal worth of all human beings.

This can be understood by the following examples.

Climate change and impact on water resources:

According to scientific projections, climate change will significantly reduce surface water and groundwater resources in most dry subtropical regions, thus intensifying competition for water. The frequency of droughts, degradation of water supplies for human consumption will increase.

Affected rights: right to water and sanitation, right to health, right to life, right to food, right to an adequate standard of living.

Climate change and its impact on agriculture

According to scientific projections, climate change will have adverse effects in India and countries in the tropics. The monsoon accounting for 75% of India’s rainfall significantly impacts country’s agriculture and livelihood of tens of millions of small farmers. Climate change is likely to intensify the variability of monsoon dynamics, leading to a rise in extreme seasonal aberrations, such as increased precipitation and devastating floods in some parts of the country as well as reduced rainfall and prolonged droughts in other areas.

Affected rights: right to food, right to an adequate standard of living, right to health.

Climate change and its impact on urban areas

Climate-related phenomena such as rising sea levels, coastal storms, heat stress, extreme precipitation, inland and coastal flooding, landslides, drought, increased aridity, water scarcity, and air pollution “will have profound impacts on a broad spectrum of city functions, infrastructures, and services and will interact with and may exacerbate many existing stresses.”

Affected rights: right to life, right to housing, right to health, right to water and sanitation, right to an adequate standard of living, right to property.

Climate change and its impact on vulnerable section

Women and children are particularly vulnerable to the effects of climate change. In the poorest regions of the world, women often bear the primary responsibility for gathering the essential food, water and fuel supplies for their families. Droughts caused by climate change make their work extremely hard as wells run dry, crop production declines, and fuel wood has to be collected from farther distances.

Similarly, shortages of food and water will increase malnutrition among children and diminish their chances to receive school education. Children are also more vulnerable to natural disasters as they lack physical strength, and are often orphaned or separated from their families.

Indigenous peoples are also particularly vulnerable to climate change, since their way of life is often inextricably tied to the natural environment. Consequently, environmental changes impact their ability to access water, food and shelter. Moreover, for many indigenous peoples, lands are not a mere commodity, but a central element of spiritual and cultural identity. Thus, serious environmental changes resulting from climate change can affect both their physical and spiritual survival.

Affected rights: right to life, right to dignity, right to health, right to water and sanitation, right to an adequate standard of living, right to property.

It is now clear that climate change caused by human activity has negative impacts on the full enjoyment of human rights.

However, to address the human rights violation linked to climate change, Rights Based approach should be followed to minimise the impact.

A rights-based approach analyses obligations, inequalities and vulnerabilities, and seeks to redress discriminatory practices and unjust distributions of power. Under this the rights-holders and their entitlements are identified as well as the corresponding duty-bearers and their obligations in order to find ways for strengthening the capacities of rights-holders to make their claims and of duty-bearers to meet their obligations.

States (duty-bearers) should have an affirmative obligation to take effective measures to prevent and redress these climate impacts, and therefore, to mitigate climate change, and to ensure that all human beings (rights-holders) have the necessary capacity to adapt to the climate crisis. Affected individuals and communities mustparticipate, without discrimination, in the design and implementation of these projects. They musthave access to due process and to remedy if their rights are violated.A rights-based response should also maximizeinclusion, participation and equality.

Therefore to conclude, the Climate justice requires that climate action is consistent with existing human rights agreements, obligations, standards and principles. Those who have contributed the least to climate change unjustly and disproportionately suffer its harms. They must be meaningfulparticipants in and primary beneficiaries of climate action, and they must have access to effective remedies.

France: Revolution and Collectivism

- by IAS Score

France remerged in the 17thcentury as the most powerful nation state in Europe over the previous 200 yrs. Variousprenrepalitions independent fiefdom and dukedoms had been absorbed by the French monarchy as it Consolidated Its power.

Long before other European nations the French has centralized production authority, an effective system of national taxation and accounting, and a standing army made up largely of professionals and conscripts who served only the state and not a multitude of private employees. Unified, wealthy and the centre of style and aristocratic culture, France also was the center of learning and social. Philosophy. The middle class who was barred form palatial power and was denied the rights and privileges of the aristocracy, was however, receptive of the idea of social Change.

The debts of an extravagant monarchy led kingLouis XVI to summon the Slate general in 1789. This feudal parliament Comprised the three medieval estates, the aristocracy, the clergy and the commoners. However, the representativesof the so called 3rdestate, not only disapproved the king’s request for money but also refused to disperse when ordered and helped to initiate an insurrection in the streets of pairs. The great revolution ultimately led to execution of King Louis XVI. Throughout the classical period (789-1919), the French tended to favor forms of social collectivism rather than individualism. Collectivist theorists viewed individuals as naturally part of, dependent or, and to some extent – subservient of the social whole.

The Young Marx, who lived in exile in Pairs during the 1840’s was influenced by French Socialist theory that how emerged during the later revolutions in France, in which govt. of workers emerged as one of the optimisms. Whereas Comte’s and Durkheim’s writings reveal the influence of the radical (socialism as a Politically radical form of Collectivism) and Conservative

Variants of French Collectivism. Both Combined the conservative emphasis on an organic view of the Collective good which radical conception of progress and equality of opportunity.Both focused on some form of collectivist restructuring for France.

Need for Capital Efficiency in Realizing Kalam Sir’s Dream of Developed India by 2020

- by IAS Score

A glory has departed. He was the greatest Indian alive in recent decades. His temper was scientific, his vision was humane and his work reflected the highest level of moral courage. He will keep on inspiring us and the coming generations to do more and better. He had a dream and a vision of making India a developed nation by 2020. He also had put forward the action plan required to realize this dream. I will try to put forward some of the hurdles we are facing in realizing that dream. Though there are many things that can be reformed including the social attitude, political culture but I keep this blog to requirement and efficiency of capital in relation to development.

What does it mean to be developed? It is a value loaded term that is why many of the classifications talk about the level of industrialization in classifying the countries and these are – Industrialized, Industrializing countries and so on. Putting it simply- his vision was to make India developed and not industrialized. We keep this here. He believed in putting expiry date on dreams too and that is 2020. How practical was he. Salute!! He had seen that dream from our eyes- the youth and old alike. His dream had the solid foundations rooted in science and is based on sound principles of economics. His Idea of PURA- Providing Urban Amenities in Rural Areas was not based on charity but on sound principles of economy and that is profit for investors.

Let me start with an economist, Eugene. According to Eugene an underdeveloped country is one that is not adequately equipped with capital in relation to its population and natural resources. What we need is the adequate capital to become developed. Before we move forward let us understand what capital is? Capital is a long term asset. Capital is something that in itself can help us generate further wealth. Investment is different from capital. Investment is a running concept. It keeps on happening. The closest proxy for investment is the capital formation. When all the money earned is utilized for consumption, there is no savings. The low savings leads to low investment. This is where we fall in chronic cycle of consumption and with one shock below poverty line.

The propensity to consume at lower level of income is high at the same time the propensity to save with the rise in income is also high. Thus, with the rise of income, the saving and investment should follow that is not happening at the expected pace in India. This higher propensity to consume with the rise in income can be explained by one of the concept in Economy and that is of the Demonstration Effect. The demonstration effect suggests that because of the influence of movies or advertisement or any other factor, people from underdeveloped countries tend to consume more even if there is a rise in income. Demonstration effect led behaviour is another economic hurdle for us along with the lack of capital in realizing his dream of a developed India by 2020.

Many of the underdeveloped countries like India marred by many dualities like social duality, economic duality and technological duality. These dualities are nothing but the contrasts. People with huge wealth and high technology exist or in fact solely flourishes along with the people who merely survives. The hunger situation and number of billionaire is an apt example of this duality. The accumulation of wealth is not because of any grand entrepreneurial feat by this capital class but because of their misuse of political and bureaucratic power, cronyism, their traditional dominance in speculative activities and real estate etc. It simply does not mean all billionaires are cronies but India remains an unfortunate example of this duality. Existence of this duality leads to capital being misused and ineffective. These dualities are another big barriers in realizing his dream of a developed India.

There is another trap, along with many other. The trap is of Conspicuous consumption. Conspicuous consumption is nothing but a consumption for showing off a particular standard of living, Just another example of misuse of capital. Though, in a different argument, it can be proved that the conspicuous consumption and demonstration effect actually leads to higher level of investment. This is a market induced investment but at crucial stage the priority sectors does not get the investment. Conspicuous consumption leaves a policy targeted for poors ineffective- the diesel subsidy is one of the examples.

Looking at malnutrition and the state of education in India, the favourable looking demography may not be utilized to the fullest extent possible. Going back to Eugene- India is not equipped to get the best out of its available resource that is demography.

I kept this talk limited to where we can improve our behaviour in relation to capital. Along with many other things like changing our social attitude, getting new capital and reforming our political culture, we can collectively work towards ensuring more saving and investment while reducing the conspicuous consumption and not falling for demonstration effect. Let us work towards achieving this grand dream, collectively. Let us rededicate ourselves in realizing this grand dream before its expiry date.

Britain : Industrialization and Utilitarianism

- by IAS Score

England was the 1st Country to experience the effects of the industrial revolution and during the 1st half of our classical period, was politically and economically in advance of all other European societies. In England, Industrialization come about without out widespread governmental assistance.

The relatively large and powerful bourgeoisie class in England was able to achieve political and ideological hegemony slowly and peaceably, without having to think themselves as a revolutionary class who had violently seized control of the state. The two major parties The Whigs and the Tories (later liberals and conservatives), though had divergent polices but they agreed on fundaments. The English Bourgeoisielook for granted the fact that their highly successful economy was in a state of natural balance.

In opposition to the collectivist and interventionist ideas held by many French Theorist, English conception of the natural balance of the market economy and English belief in the general utility of enlightened self-interest led to the conclusion that there was no contradiction between action that is taken for the social or collective good and actions that is taker for reasons of self interest. Deregulation, decentralization and political freedom were important values during 1800s. These values were expressed ideologically and were used against the privileges of the landed aristocracy by the commercial and business classes. The rapid industrialization effectively fostered the belief the world could and should be improved by the rational actions of self-interested individuals. Unlike France, Where equality came to be thought of as equality of outcome, in England equality predominantly meant equality to compete and therefore inequality of outcome.

2. Thus, Durkheim argues, it was English competitive individualism that made the philosophical school of utilitarianism possible and meaningful. This idea of Utilitarianism was central to the sociological theory of Herbert Spencer.

DISINVESTMENT: Policy and Initiatives by NDA Government

- by IAS Score

With the regime change last year, the disinvestment policy was expected to be revised after hitting the nadir (lowest point) in previous UPA Government’s 10 year rule. The following article is an a analysis of Disinvestment policy in past one year.

Three approaches to disinvestment

There are primarily three different approaches to disinvestments (from the sellers’ i.e. Government’s perspective)

| 1 | Minority stake sale(Minority Disinvestment) | A minority disinvestment is one such that, even after selling the stakes, the government retains a majority stake in the company, typically greater than 51%, thus ensuring managerial control.Generally these are done via public offers i.e. offloaded to the public by way of an Offer for Sale (but can also be offloaded to financial institutions ) |

| 2 | Strategic sale(Majority Disinvestment) | A majority disinvestment is one in which the government, post disinvestment, retains a minority stake in the company i.e. it sells off a majority stake. Historically, majority disinvestments have typically been made to strategic partners.Again, like in the case of minority disinvestment, the stake can also be offloaded by way of an Offer for Sale, separately or in conjunction with a sale to a strategic partner. |

| 3 | Complete Privatisation | Complete privatization is a form of majority disinvestment wherein 100% control of the company is passed on to a buyer(s). |

1) Fiscal Year 2014-15

- a) In Banks

- To be in line with Basel-III norms, as there is a requirement to infuse 2,40,000 crore as equity by 2018 in our banks. To meet this huge capital requirement, we need to raise additional resources to fulfill the obligation.

- In this background, in Dec-2014, the Cabinet approved allowing PSBs (Public Sector Banks) to raise capital from markets through FPO (Follow-on Public Offer) or QIP (Qualified Institutional Placement) by diluting Government of India holding up to 52% in phased manner.

- b) in PSUs (Central Government)

- In the last fiscal (i.e. 2014-15), the government had raised around Rs 24,200 crore through stake sales in Coal India Ltd and Steel Authority of India Ltd (SAIL).

- CIL disinvestment was was the biggest equity offering ever in the country (a 10 % stake in CIL, fetched government, the Rs.24,557 crore, whereas selling of shares in SAIL led to earning of mere Rs.1,719 crore). But on the downside as much as Rs.11,360 crore, which is half of the total sum raised, came from insurance companies led by the LIC, with the latter accounting for a bulk of the applications in this category. This is nothing more than money moving from one hand of the government to the other given that the LIC is wholly owned by the Centre.

2) Fiscal year 2015-16

The NDA-II government’s first full Budget in February announced an ambitious, but achievable amount of Rs 69,500-Crore plan to sell stakes in government companies. It will be the country’s biggest disinvestment program so far. Of this, the government has budgeted

- Rs 41,000 Crore through minority stake sales in profit making public sector units, and

- Rs 28,500-Crore via strategic disinvestment in sick PSU’s

Some 65 sick Central Public Sector Enterprises (CPSEs) as of march 31, 2014 like Air India (AI), Fertilizer Corporation of India, Hindustan Shipyard, HMT, Mahanagar Telephone Nigam Ltd (MTNL), Bharat Coking Coal and ITI will be taken up under strategic disinvestment. (A CPSE is considered sick if it has accumulated losses in any financial year equal to 50 per cent or more of its average net worth in immediately preceding year)

The Govt aims to launch at least one issue per month to meet this target, provided market conditions remain favorable.

The government is expected the disinvestment programme for 2015-16, as early as the first month of new fiscal year. The disinvestment department is in a position to start early as it has secured the Cabinet approval for stake sales in 10 companies, including Power Finance Corporation, Bharat Heavy Electricals Ltd (BHEL), Rural Electrification Corporation and NHPC.

Besides smaller issues, the disinvestment department also has approval for 10 per cent stake sale in IOC and 5 per cent in ONGC, which may fetch it around Rs 21,000 crore at current market prices. But the time is not conducive for stake sale in oil firms such as ONGC or IOC because of the global situation and also because of subsidy issues.

3) Comment w.r.t 2015-16 plan

If conducted strategically and with good institutional support, the disinvestment is a win-win situation for government, company as well as shareholders.

- Firstly, it is likely to help in improving the functioning of PSUs by bringing better management practices and corporate governance from private sector. Further, listing on stock exchanges will lead to an increase in transparency, accountability, and public scrutiny of PSUs.

- Secondly, it helps to unlock the value of PSUs. According to a study, Market capitalization of five companies which have been listed since October, 2004 has increased by 3.8 times from the book value of Rs.80,000 crore to Rs.3 lakh crore in 2010.

- Thirdly, the revenue raised by disinvestment has helped in reducing fiscal deficit, to finance selected social sector schemes and to meet the capital investment requirements of profitable and revivable CPSEs. A National investment fund has already been created for that purpose.

- It helps to promote people’s ownership in CPSEs.

Thus, this resurgence in disinvestment by the new govt, should be welcomed .

Though the target may be achievable, given the improving macro-economic factors and buoyant investor sentiments, the historical disinvestment approach has been laden with issues like price volatility, sporadic offerings and concentration towards end of the fiscal. The Disinvestment Programme, since it began in the early 1990s, has managed to meet the budgeted targets only thrice.

Thus to make this a reality we need to ensure the following:

- Firstly, a stable policy outlook and a clear growth road map are required for making PSUs attractive for investors and to ensure wider participation in disinvestment programmes. The government has already embarked on the process to streamline coal allocation in a transparent manner, which has cleared the uncertainty haze in the power sector. Similarly, a well-defined subsidy sharing mechanism and a road-map for their eventual phasing-out would make oil and gas sector far more attractive for investors.

- Secondly, a focused approach to maximize yield and minimize cost also needs to be adopted. In this backdrop, the disinvestment programme should be revolving around the seven Maharatna companies which form 62 per cent of the total market capitalisation (M-Cap) of all listed PSUs and contribute 8.5 per cent to GDP.

- Thirdly, There are several unlisted PSUs with total net profit of over Rs 20,000 crore which can be tapped to diversify offerings. With numerous profit-making companies in attractive and upcoming sectors like defence, railways, general insurance, and nuclear power, there are a variety of options that can be explored to further invigorate the disinvestment drive. Also, hiving off attractive but under utilized assets like land, telecom towers, etc of unlisted PSUs is another possibility.

- Fourthly, Take innovative disinvestment routes. There have already been a few innovative steps from the department of disinvestment in the past few years which have addressed some of the legacy issues with the Indian disinvestment programme. The recently frequented OFS (offer for sale) route has helped reduce time and increased transparency.

- Then we need to deal with trade unions who resists any sell-off and threatens to go on strike as seen in the recent case of CIL.

- Finally, a well spaced out and uniformly spread-out disinvestment programme (instead of undertaking all disinvestment in the end of fiscal year) would not only help investors plan accordingly, but also help government raise higher amounts by weeding out price volatility.

While exercising this policy, most important leakage occurs due to corporate corruption in political circles to receive the favorable deals, as the sale of stakes is similar to sale of natural and other scarce resources, such as in telecom spectrum case or allocation of coal blocks. Thus, government must ensure complete transparency in the bidding and award process to make sure that, such leakages do not occur as it happened during the previous Government regime in allocation of resources.

Railway Modernization and Rail Budget 2015-2016 Analysis

- by IAS Score

Issues concerning rail infrastructure in India :

-

- Low Operating Ratio: Railways spend 94 paise out of every rupee it earns on operating expenses like maintenance and staff salary. This leaves very little investible surplus. A part of this surplus is used to renew the depreciated inventory like worn out coaches or repair work at old stations. The lack of investment in rail infrastructure is partly responsible for poor service delivery and lack of passenger safety.

- Cross Subsidization: To keep the cost of passenger fares low, railways has increased the cost of freight(goods transport). This makes railways uncompetitive when it comes to transporting goods. Most manufacturers, therefore, prefer to rely on roads network for transporting goods. This has an added disadvantage of environmental pollution as vehicles have a larger carbon footprint than relatively cleaner railways.

- Lack of an Independent Rail Tariff Authority: It is politically infeasible to raise the passenger fare since a large number of regular commuters would not welcome any hike in the fare. It is essential that an independent authority determine the passenger fare and link it to the cost of transport in a transparent manner. However, this authority is yet to see the light of day. Such an authority needs to be set up via an act of the parliament.

- Lack of Professional Management: Railways is run like a government department instead of a profit-making, competitive business. Government announces many populist measures like new rails on lines with low traffic even though these lines are not profitable. Similarly rail museums do not generate significant revenues for the government. Data released as part of the rail budget indicates railways outgo on net social service obligation in the current financial year (2014-15) stood at Rs 25,912 crore. Net social service obligation refers to the loss encountered by railways due to underpricing of services for achieving certain social objectives.

- Failure to attract FDI in Key Projects: 100% FDI is allowed through automatic route in railway infrastructure, high speed rail system and dedicated freight corridor. FDI attracted in 2013 fiscal was barely 3000 crore against an investment target of 50,000 crore rupees.

Continue reading “Railway Modernization and Rail Budget 2015-2016 Analysis”

Union Budget 2015: Steps to curb Black Money

- by IAS Score

The Union Budget 2015 introduced various measures to curb the circulation of black money and bring more and more income into the tax purview; particularly it has included most of the suggestions of the SIT (special investigation team) have been considered. Following can be considered as the most important takeaways from the budget regarding the new law on black money and other proposed measures.

Features of the new Law on Black Money

(1) Concealment of income and assets and evasion of tax in relation to foreign assets will now be prosecutable with punishment of rigorous imprisonment up to 10 years. Further,

- this offense will be made non-compoundable;

- i.e., the offenders will not be permitted to approach the Settlement Commission; and

- penalty for such concealment of income and assets at the rate of 300% of tax shall be levied.

(2) Non filing of return or filing of return with inadequate disclosure of foreign assets will be liable for prosecution with punishment of rigorous imprisonment up to 7 years.

(3) Income in relation to any undisclosed foreign asset or undisclosed income from any foreign asset will be taxable at the maximum marginal rate. Exemptions or deductions which may otherwise be applicable in such cases shall not be allowed.

(4) Beneficial owner or beneficiary of foreign assets will be mandatorily required to file return, even if there is no taxable income.

(5) Abettors of the above offenses, whether individuals, entities, banks or financial institutions will be liable for prosecution and penalty.

(6) Date of Opening of foreign account would be necessarily required to be specified by the assessee in the return of income.

(7) The offense of concealment of income or evasion of tax in relation to a foreign asset will be made a predicate offense under the Prevention of Money-laundering Act, 2002 (PMLA). This provision would enable the enforcement agencies to attach and confiscate unaccounted assets held abroad and launch prosecution against persons indulging in laundering of black money.

(8) The definition of ‘proceeds of crime’ under PMLA is being amended to enable attachment and confiscation of equivalent asset in India where the asset located abroad cannot be forfeited.

(9) The Foreign Exchange Management Act, 1999 (FEMA) is also being amended to the effect that if any foreign exchange, foreign security or any immovable property situated outside India is held in contravention of the provisions of this Act, then action may be taken for seizure and eventual confiscation of assets of equivalent value situated in India. These contraventions are also being made liable for levy of penalty and prosecution with punishment of imprisonment up to five years.

Regarding curbing the domestic black money, a new and more comprehensive Benami Transactions (Prohibition) Bill is likely to be introduced in the current session of the Parliament. The upcoming law will enable confiscation of benami property and provide for prosecution, thus blocking a major avenue for generation and holding of black money in the form of benami property, especially in real estate.

A few other measures are also proposed in the Budget for curbing black money within the country. The Finance Bill includes a proposal to amend the Income-tax Act to prohibit acceptance or payment of an advance of INR 20,000 or more in cash for purchase of immovable property.

Quoting of PAN is being made mandatory for any purchase or sale exceeding the value of INR 1 Lakh. The third party reporting entities would be required to furnish information about foreign currency sales and cross border transactions. Provision is also being made to tackle splitting of reportable transactions. To improve enforcement, CBDT and CBEC will leverage technology and have access to information in each other’s database.

Appendix: Concept of Black Money

Black Money by definition is the unaccounted income, or income out of national income purview. It can be accumulated through legal and illegal means, thus sometimes it is accumulated either because of intention of tax evasion, and sometimes because the source of income cannot be revealed. Examples can vary from; income earned through extra work, which can’t be declared, for example, a government school teacher earning more money through private tuition or income earned through corrupt practices. Similarly, it can also be a result of income which can be declared, for example, business income, but the businessman doesn’t want to pay the tax on entire income and save money. All such aberrations in reporting to earned income to tax authorities’ accounts to increase in circulation of black money.

It is also called parallel economy, because it works around the same principles and complexities as the accounted economy, but runs parallel to it unaccounted.

Problems of Black Money

Black money in simple terms almost always goes into criminal activities or unethical business practices as it can’t be utilized into legal activities as the source of money can’t be declared. Thus, once an income is out of tax purview, it further breeds black money. Similarly it also feeds criminals, money launderers, and anti national elements. Another sector which is most severely affected by black money is real estate, and it was black money laundering into real estate which made properties so expensive. This is a serious issue as it not only makes housing unaffordable for common people, it also makes the process of starting new business very expensive and thus, hurts growth, innovation, and entrepreneurship.

(Second in three Article Series on Budget)

Gaurav Bansal

Tax Reforms and Union Budget 2015: Are we moving towards an ‘Optimal Tax’ structure?

- by IAS Score

With General Anti-Avoidance Rule (GAAR) and Goods and Services Tax (GST) to be implemented in couple of years and Union Budget’s rational announcements regarding the broader Tax reforms, it may very well be the case.

The Indian budget, made a couple of entirely sensible changes to the tax system. One is the abolition of the wealth tax, the other is the idea of lowering the corporate profits tax rate, but broadening the base, as it is collected upon by removing some exemptions and allowances.

The assurance of reducing the corporate tax rate from 30% to 25%, though over the next four years means a further thrust and push towards “Make in India” as the move will bring India’s corporate tax system at par with the global structure. While phasing out of the exemptions that lead to litigation and distortion in the tax system will ensure that the revenues are not affected much.

Service Tax Issue in short Run

The budget aimed at fiscal consolidation and tax reform has been carried on but the increase in service tax is likely to fuel inflation due to price rise, until GST is implemented fully. It would also be more cumbersome for the government to reign-in inflation given the fact that, currently we have multiple taxes on the same product, as many products in India invite both VAT and Service Tax and until these two are integrated into GST it would not be solved. As a consequence interest rates would not come down and the much needed impetus to manufacturing would be lacking, despite making so many concessions to the corporate sector.

However, in the long Run, the problem will be solved with the introduction of GST and in fact even in the short run also, the increase in service tax to 14% should be seen as precursor to GST implementation as the proposed tax rate under GST has also been recommended as 14-18 percent.

Impact of Wealth Tax Abolition

Before this budget, any Individual, or a Hindu undivided Family had to pay a wealth Tax as 1% on net wealth, over 30 lakh INR. Not only this included multiple taxation during each succession, it was also a difficult tax to track and administer, as a result expenditure on tax collections was higher than the tax collections themselves. It also involved high evasion and lead to generation of black money. Thus, it been rightfully removed. Finance minister Arun Jaitley said, “Should a tax which leads to high cost of collection and a low yield be continued or should it be replaced with a low cost and higher yield tax?” However, overall tax collections aren’t likely to fall as, the government has introduced an additional 2% surcharge for those earning over 1 Crore INR p.a.

(First in three Article Series on Budget)

Gaurav Bansal

The Right to Fair Compensation and Transparency in LARR Ordinance, 2014

- by Manoj K. Jha

History of land acquisition laws in India

Colonial period: History of Land acquisition laws even precede the year 1894, most notable was Bengal Regulation I of 1824. The colonial administration of Presidency towns made such land acquisition laws which later spread across the country to facilitate the easy acquisition of land and other immovable properties for roads, canals and other public purposes with compensation to be determined by specifically appointed arbitrators. After 1857 strategic interests of the colonial administration expanded to cantonment areas, garrisons, telegraph, railways etc. None of those legislations provided any opportunity to object to the acquisition of land itself, however allowed the opportunity to raise issues regarding compensation. The debate on compensation was never settled. Even then the market value and public purpose wasn’t properly defined. The allegations of inadequacy, corruption and misconduct related to land acquisition were common.

The Land Acquisition Act of 1894, meant to bring some uniformity to the acquisition decisions of the Empire. It meant to amend the law for the acquisition of land for public purposes and for companies and to determine the amount of compensation to be made on account of such acquisition. This meant a single law to regulate all land acquisition across the country. In a predominantly agricultural landscape, such a law was aimed at generating revenue from the productive uses of land.

Post Independence India: Even after adoption of the Indian Constitution, the 1894 Land Acquisition Law continued to be in force, albeit with periodic amendments. The new cities of Jamshedpur, Chandigarh, Bhilai and others were made as a part of the Nehruvian vision of modernity. The State also expanded its economic reach by focusing on heavy industries and linked infrastructure, for which availability of land was a pre-requisite.

In light of the State’s predominant role in national development the land acquisition in the constitutional scheme was put in Concurrent list, with power to both Centre and States to make laws on acquisition of land. The right to property was initially considered a fundamental right. It was inevitable that this right and laws related to land acquisition will collide. The Constitution was ultimately amended with insertion of Article 300A in the Constitution, which states that ‘no person shall be deprived of his property save by authority of law’ and hence the right to property was made a constitutional right only and not a fundamental right. The protection was given only against actions of executive not the legislature. So legislature of both states and center could make laws to take away the land from the land owners.

Present Day Land Acquisition Laws: The act of 1894 survived till 2013 and finally paved way for the new law namely the Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act 2013 (LARR).

The preamble of LARR is as follows: It aims to “ ensure a humane, participatory, informed consultative and transparent process for land acquisition for industrialization, development of essential infrastructural facilities and urbanization with the least disturbance to the owners of the land and other affected families and provide just and fair compensation to the affected families whose land has been acquired or proposed to be acquired or are affected by such acquisition and make adequate provisions for such affected persons for their rehabilitation and resettlement thereof, and for ensuring that the cumulative outcome of compulsory acquisition should be that affected persons become partners in development leading to an improvement in their post acquisition social and economic status and for matters connected therewith or incidental thereto”.

The preamble itself declares the intent for bringing the new land acquisition law to fore. For the first time the land acquisition law and laws related to compensation, rehabilitation and resettlement was combined together. Salient features of LARR are:

- Somewhat defines public purpose: it states the context in which land acquisitions can be termed as public purposes. The list even includes private sector projects to qualify as public purpose. Specifically mentioned public purposes are strategic purposes relating to armed forces of the Union, national security or defence, police, safety of the people, land for railways, highways, ports, power, irrigation, public sector companies, land for the project affected people, etc. It restricts the use of urgency clause to defence, national security and natural calamities. It means urgency clause is limited to very urgent situations.

- Combined law: Land Acquisition and Rehabilitation & Resettlement(R&R) need to be seen necessarily as two sides of the same coin. Earlier R&R were provided by different laws. Not combining the R&R and land acquisition within one law leads to neglect of R&R.

- Both LA and R&R Provisions will apply when: (a) Government acquires land for its own use, hold and control (b) Government acquires land with the ultimate purpose to transfer it for the use of private companies for stated public purpose (including PPP projects but other than state or national highway projects) (c) Government acquires land for immediate and declared use by private companies for public purpose. For both B and C public purpose stated once can’t be changed.

- Provides for procedural safeguards of consent by project affected people: The act provides that consent of 70% of project affected people must be taken if the acquisition is made by the government for its own use, hold and control. If taken for private sector projects then consent must be given by 80% of project affected people.

- Provides for other procedural safeguards: Other procedural safeguards like Social Impact Assessment by independent people to weigh pros and cons of the land acquisition in particular area. For SIA Gram Sabha must be consulted. Another procedural safe guards are Multi-crop irrigated land will not be acquired except as a demonstrably last resort measure, which in no case should lead to acquisition of more than 5 percent of multi-crop irrigated area in a district. Wherever multi crop irrigated land is acquired an equivalent area of cultivable wasteland shall be developed for agricultural purposes. In districts where net sown area is less than fifty per cent of total geographical area, no more than ten per cent of the net sown area of the district may be cumulatively acquired under all land acquisition projects put together in that district.

- Fair compensation mechanism: The mechanism includes compensation up to four times the average market value according to the Stamp Act in rural areas and for urban areas the compensation is two times the market value. In addition to the compensation there are other payments for resettlement and rehabilitation. The act also provided to timely payment of compensation to the affected people. In case the acquired land is sold later at a higher rate, then 40% of the profit made must be shared with the people who last the land in the process of acquisition.

A comprehensive R&R package is given in Schedule II of the act.

R&R is applicable to both land owners as well as people dependent on the land acquired:

- Subsistence allowance at Rs. 3000 per month per family for 12 months;

- The affected families shall be entitled to one of the following based on choice of the project affected family:

- where jobs are created through the project, employment for one member per family;

- rupees 5 lakhs per family; and

- rupees 2000 per month per family as annuity for 20 years, with appropriate index for Inflation.

- If a house is lost in rural areas, a constructed house shall be provided as per the Indira Awas Yojana specifications.If a house is lost in urban areas, a constructed house shall be provided, which will be not less than 50 sq mts in plinth area. In either case the equivalent cost of the house may also be provided in lieu of the house as per the preference of the project affected family;

- One acre of land to each family in the command area, if land is acquired for an irrigation project;

- Rs 50,000 for transportation.

- The infrastructural facility to be provided in area of resettlement are: Schools and playgrounds, Health centres, Roads and electric connections, Assured sources of safe drinking water for each family, Panchayat Ghars, Anganwadi’s providing child and mother supplemental nutritional services, Places of worship and burial and/or cremation ground, Village level Post Offices as appropriate with facilities for opening saving accounts and Fair price shops and seed-cum-fertilizer storage facilities .

- Application of bill on prior acquisition: This Bill proposes that LARR 2011 will apply to all cases of Land Acquisition where before date of commencement of LARR Act either (a) Award has not been made under LA Act 1894; or (b) Possession of land has not been taken.

- Compliant with other laws: The bill is compliant with other laws Like The Panchayats (Extension to the Scheduled Areas) Act, 1996, The Scheduled Tribes and Other Traditional Forest Dwellers (Recognition of Forest Rights) Act, 2006, Land Transfer Regulations in Schedule V Areas etc.

- Stringent and Comprehensive Penalties Regime for Companies and Government: the act provides for Punishment for false information, mala fide action, etc. Penalty for contravention of provisions of Act.

- LAAR does not apply to many significant enactments pertaining to land acquisition and use, including, the following enactments: a) The Special Economic Zones Act, 2005, b) The Cantonments Act, 2006, c) The Land Acquisition (Mines) Act, 1885 [will the new Mines and Minerals(Development and Regulation) Bill, 2011 also be among the exceptions?), d) The Metro Railways (Construction of Works) Act, 1978, e) The National Highways Act, 1956, f) The Petroleum and Minerals Pipelines Act, 1962, g) Resettlement of Displaced Persons (Land Acquisition) Act, 1948 h) The Coal Bearing Areas Act, 2003, i) The Electricity Act, 2003, etc.

Background for bringing the ordinance

LARR was meant to make the acquisition process just. It was designed in the mode of the previous government’s other landmark laws on information, education, and food — using a rights-based approach — where the primary objective was to deliver “fairness” to the people affected by land acquisition. LARR expanded the definition of project-affected people and expanded the rights, protections and compensations for people who lose land or livelihood as a result of acquisition. All these were laudable and necessary. But LARR was also a purely political and fundamentally bureaucratic approach based on little or no recognition of some simple economic principles — on land markets and on transaction and opportunity costs. The underlying presumption was that the price of land matters to the land-loser but not to the land-acquirer; as a result, LARR raised the price of land acquisition to unsustainable levels.

This price is not simply the money paid for acquisition and rehabilitation and resettlement. That is just one component of price, its direct component. There is a second component, an indirect price. This includes (a) transaction costs, which include the cost of doing social impact assessments, conducting referenda, running the massive new multilayered acquisition bureaucracy, etc. and (b) opportunity costs, which arise from the time taken to conclude an acquisition — doing social impact assessments, conducting referenda, etc. — time during which capital is not invested, infrastructure is not created, and production does not take place. If all the steps defined in LARR were accomplished in the allotted time, each acquisition would require about five years; in practice, it could take a lot longer. Longer period of time means longer gestation period for projects which will render them unviable. LARR had placed an impossible double-burden on land acquirers: pay double or quadruple the highest prices in the world, and wait for several years to begin work on the ground. The first burden remains and its consequences are grave. What those consequences may be must be carefully worked out by people competent to do so. But the second burden has been mitigated by this ordinance. It should make life easier for the land-acquirer. The stringent consent requirement makes it very difficult to acquire land even for public purposes. The punishment provision for the bureaucrats also makes acquisition difficult as many fears any mistake will make them liable for punishments. The current government seeks to speed up the development process which needs the balance between interests of people affected by the land acquisition and the needs of the industry. The ordinance is also expected to remove the difficulties faced by bureaucrats approving the land acquisition.

The salient features of the ordinance are as follows:

- Expansion of the scope of compensation: The amendment has extended the scope of compensation by including the various acts listed in schedule IV which were exempted by LARR. Some of the 13 acts are Ancient Monuments and Archaeological Sites and Remains Act 1958, Atomic Energy Act 1962, etc.

- Relaxation of consent and social impact assessment requirements: the amendment have relaxed the requirements of consent and social impact assessment survey for projects in five areas of national security and defense, rural infrastructure and electrification, affordable housing for poor, development of industrial corridor including infrastructure and social infrastructure including PPPs in which ownership rests with the government.

- Higher rate of compensation as provided in LARR has been retained without any change.

- Relaxation of procedural requirement: the procedure of land acquisition with bureaucracy has been changed to make the acquisition faster. Bureaucracy has been given protection by including the requirement of the prior permission of the government before a court can take cognizance of the offense under the Act.

GS: Swimming in the ocean

- by Manoj K. Jha

For the bright and ignited minds of India, Civil Services have always been the ultimate career choice.

By Manoj K. Jha

Success is a diffused term. It is hard to define success. But lone substance is assured only with positive outcome of the effort, put by any one to the direction of one’s goal. Appearing for civil services has always been a tough decision to make and an act of courage in itself which demands a strong character and steely nerves. This is basically because of three reasons:

• Because of the character of the syllabus associated with it, wherein you are expected to know almost everything under the sun. Now the new dimension in the whole strategy is about concept-integration-approach.

• Because of the unpredictability of the exam wherein you cannot afford to make selective study purely based on previous years question papers. How your study, information and knowledge are updated finally matters.