| Q |

A |

| Context: |

To facilitate the ease of doing business in the country and to remove the difficulties faced by stakeholders, government of India has proposed amendments in the Companies Bill, 2016. |

| Objective of the Bill: |

The objectives are:

- Addressing difficulties in implementation owing to stringent compliance requirements;

- Facilitating ease of doing business in order to promote growth with employment;

- Harmonisation with accounting standards, the Securities and Exchange Board of India Act, 1992 and the regulations made thereunder, and the Reserve Bank of India Act, 1934 and the regulations made thereunder;

- Rectifying omissions and inconsistencies in the Act.

|

| Highlights of the Bill: |

- The Bill amends the Companies Act, 2013 in relation to structuring, disclosure and compliance requirements for companies.

- The Act limits the number of intermediary companies through which investments can be made in a company. Similarly, the Act limits the number of layers of subsidiaries a company can have. The Bill removes these limits.

- The Act requires an individual who has a beneficial interest in the shares of a company to disclose the same. The Bill also requires a group of persons who exercise beneficial control (above 25%) in a company to disclose such interest.

- Under the Act, a separate offer letter should be issued to individuals to whom a private offer of shares has been made. The Bill removes the requirement of such offer letter, but retains the provision related to notifying the Registrar of the return of allotment.

- The Act permits the appointment of members at the level of Joint Secretary to the quasi- judicial tribunal. Under the Bill, a technical member must be at least of the level of an Additional Secretary.

Several of the proposed amendments are corrective, curative in nature to simplify, soften the provisions of the Act. Most of the changes are based on recommendations of the CLC (Companies Law Committee). |

| What will be the effective date? |

For curative/declaratory amendments, the amendments will date back to the date of the original law, for substantive amendments, the date of the Amendment Act being made effective. |

| What are its Key Issues? |

The 2013 Act prohibits companies from making investments in other companies through more than two layers of intermediary companies. These provisions sought to address issues related to i) tracing the source of investments in companies and their ultimate use, and ii) use of multiple levels of subsidiaries to siphon funds.

The Bill removes the limit on layers of subsidiaries and intermediaries. This is in line with the Companies Law Committee’s (CLC) recommendations which noted that imposing such limits would affect the company’s structuring and ability to raise funds.

- The 2013 Act does not permit an Independent Director to have a pecuniary relationship with the company, other than his remuneration. The Bill permits an Independent Director to have a pecuniary relationship, up to 10% of his total income, with the company. This is in line with the reasoning of the CLC which had stated that minor transactions may not compromise the independence of such Directors.

- Companies are allowed to raise capital by selling securities, shares & debentures to investors. This is called private placement. The companies Act, 2013 mandates the companies to submit a separate offer letter disclosing certain information about the company, when a private placement is offered to an investor. The Bill simplifies the process by doing away with filing of the separate offer letter.

- Forward dealing or forward contract is the act of purchasing securities of a company for a specific price for specific future date. The companies Act, 2013 prohibits directors and key managerial personnel of a company from engaging in forward dealing. But the new bill proposes to remove this provision of the Act. Similarly, the Bill seeks to remove provisions of the Act, which prohibit insider trading in companies. Insider trading is the act of publicly trading stocks of a company by a person who has confidential information about the company, not known to the public.

|

| What are the voting provisions for different companies? |

- Private companies: Bar on related party voting does not apply.

- Government companies: Transactions between 2 government companies exempted.

- Public listed companies:

- If going under sec. 188, related parties shall not vote, unless covered by the numerical majority threshold

- If going under Listing Regulations, all related parties shall not vote

|

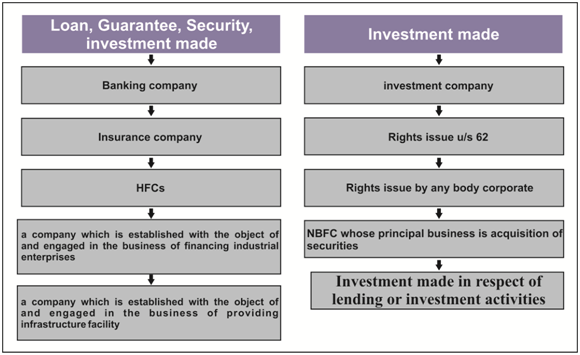

| Loans and investment by the companies: |

In this bill Provisions of investment through layers of investment companies to be omitted. The provisions with respect to aggregation of loans and investments for the purpose of calculating limit to be provided.

Loans to directors and other interested persons:The present Act prohibits provision of loans by a company to its directors, or its holding companies, etc. The Bill seeks to limit this prohibition by requiring passage of a special resolution in some of these cases

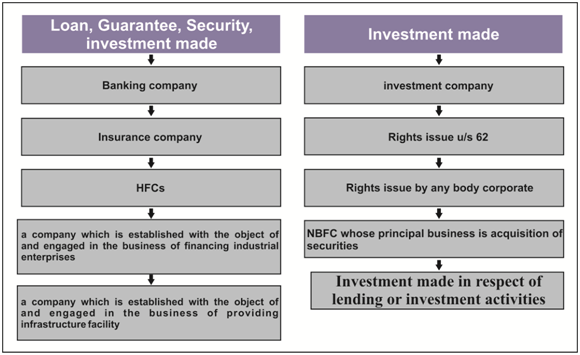

Investments made to a company through investment companies:

The Companies Act, 2013 prohibits investments made to a company through layers of more than two investment companies. The Bill removes this provision.

Exemption provided:

|